Tax Benefits for Child Daycare Providers and Users – Henssler Financial

Special tax benefits are available for those providing daycare services for children and the parents who pay for those services. We take a look at the various tax deductions daycare providers may use and the childcare tax credit that the parents may claim.

Child Care Tax Credit Ability Connection Colorado

T22-0242 - Tax Benefit of the Child Tax Credit (CTC), Baseline

Family Child Care 2023 Tax Workbook And Organizer - By Tom

Newsletter: Child Care Is a Budget Buster: Take Advantage of These

Tax Benefits for Child Daycare Providers and Users – Henssler Financial

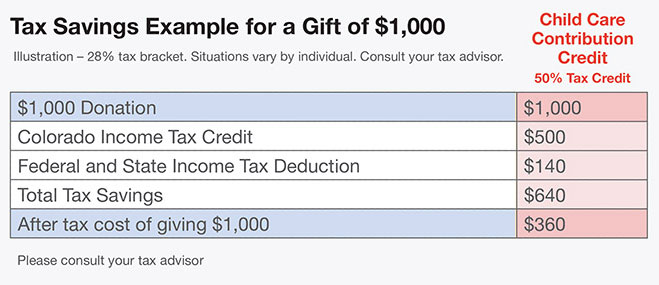

Tax Credit- Child Crisis Arizona- Qualifying Foster Care Organization

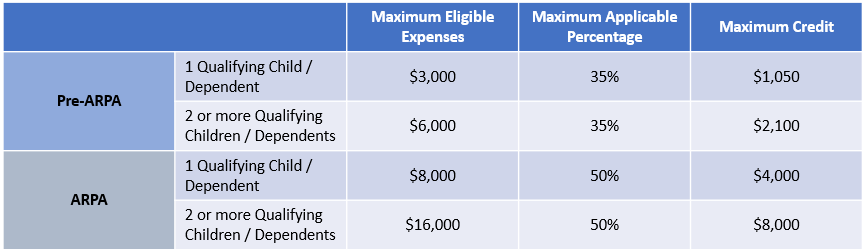

Big Changes to the Child and Dependent Care Tax Credits & FSAs in

Child Care Financial Assistance Now Available for COVID-19

PSA: You can now pay for childcare with pre-tax dollars with the

Phoenix Disabled Adult Child (DAC) Benefits

Tax Benefits for Child Daycare Providers and Users – Henssler Financial

Child Tax Credit Definition, Eligibility, Calculation, and Impact

Tax Credit Donation