:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg)

Straight Line Basis Calculation Explained, With Example

Straight line basis is the simplest method of calculating depreciation and amortization, the process of expensing an asset over a specific period.

What is Straight Line Depreciation Method?

Straight Line - FasterCapital

What Is Replacement Cost and How Does It Work?

:max_bytes(150000):strip_icc()/absolute_physical_life_final-087ee6db2fe647eb87aa6e8c06b06a67.png)

Absolute Physical Life: What It Means, How It Works

:max_bytes(150000):strip_icc()/Amazon3-88916bd66a244178b1f977a1d758dda0.JPG)

Amortization vs. Depreciation: What's the Difference?

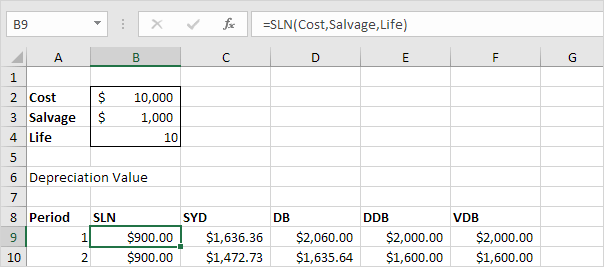

8 ways to calculate depreciation in Excel - Journal of Accountancy

Furniture, Fixtures, and Equipment – FF&E Definition

Depreciation Expense Double Entry Bookkeeping

Depreciation Formulas in Excel (In Easy Steps)

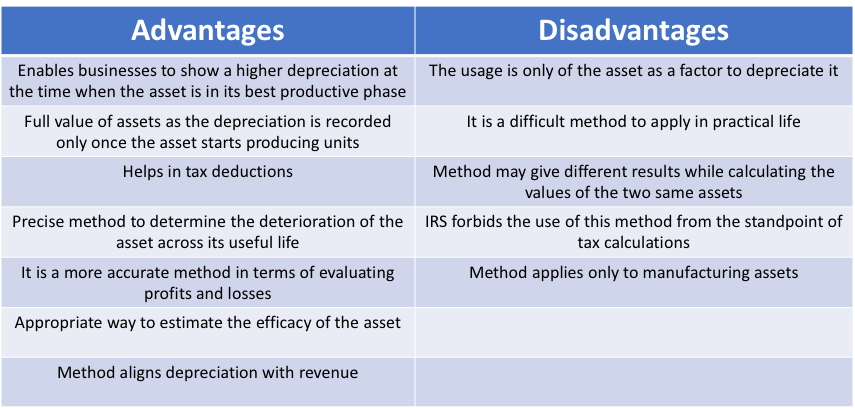

Calculating Depreciation - Unit of Production Method

限定セール Hints, UP! [12 CD - OLD BASIS Allegations FOR CD Collective Album NEW WAKE STYLE WAKE UP

:max_bytes(150000):strip_icc()/GettyImages-691574679-14de044f6a2b4d8696564badf2397006.jpg)

How Does Goodwill Amortize?

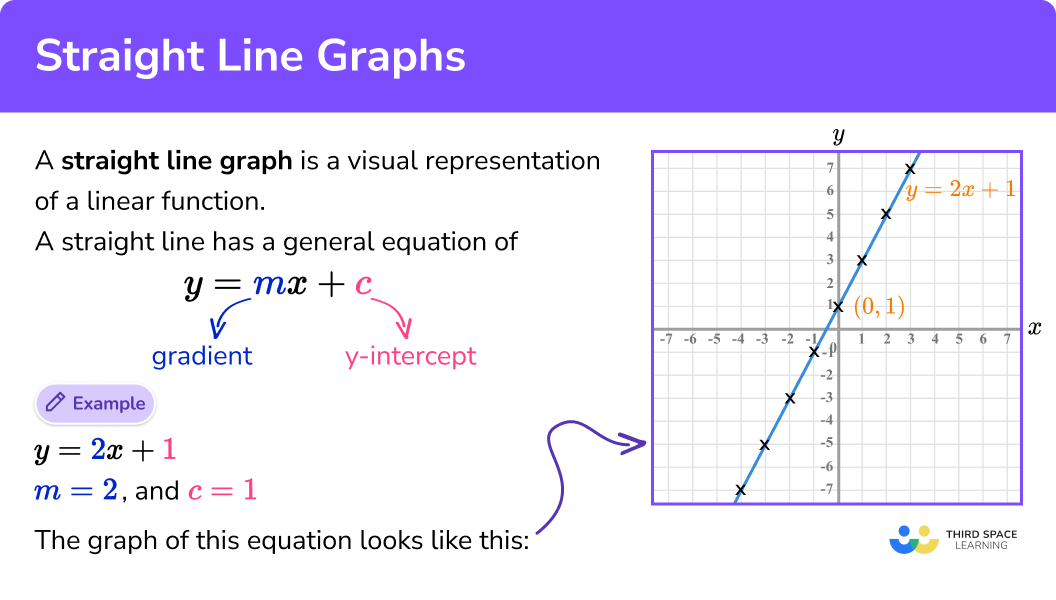

Straight Line Graphs - GCSE Maths - Steps & Examples

:max_bytes(150000):strip_icc()/Goodwill-impairment_4-3-v2-928a96590f62417f90867fed69a32ede.jpg)

How Does Goodwill Amortize?

:max_bytes(150000):strip_icc()/GettyImages-671056994-fbd4d68eda99417cbbbc2a8c67a86b03.jpg)