:max_bytes(150000):strip_icc()/GettyImages-137552576-1--5754396c3df78c9b46367699.jpg)

Office Supplies and Office Expenses on Your Business Taxes

Deducting office supplies and office expenses, the new simpler IRS rule for expensing rather than depreciating, and where to put on your tax return.

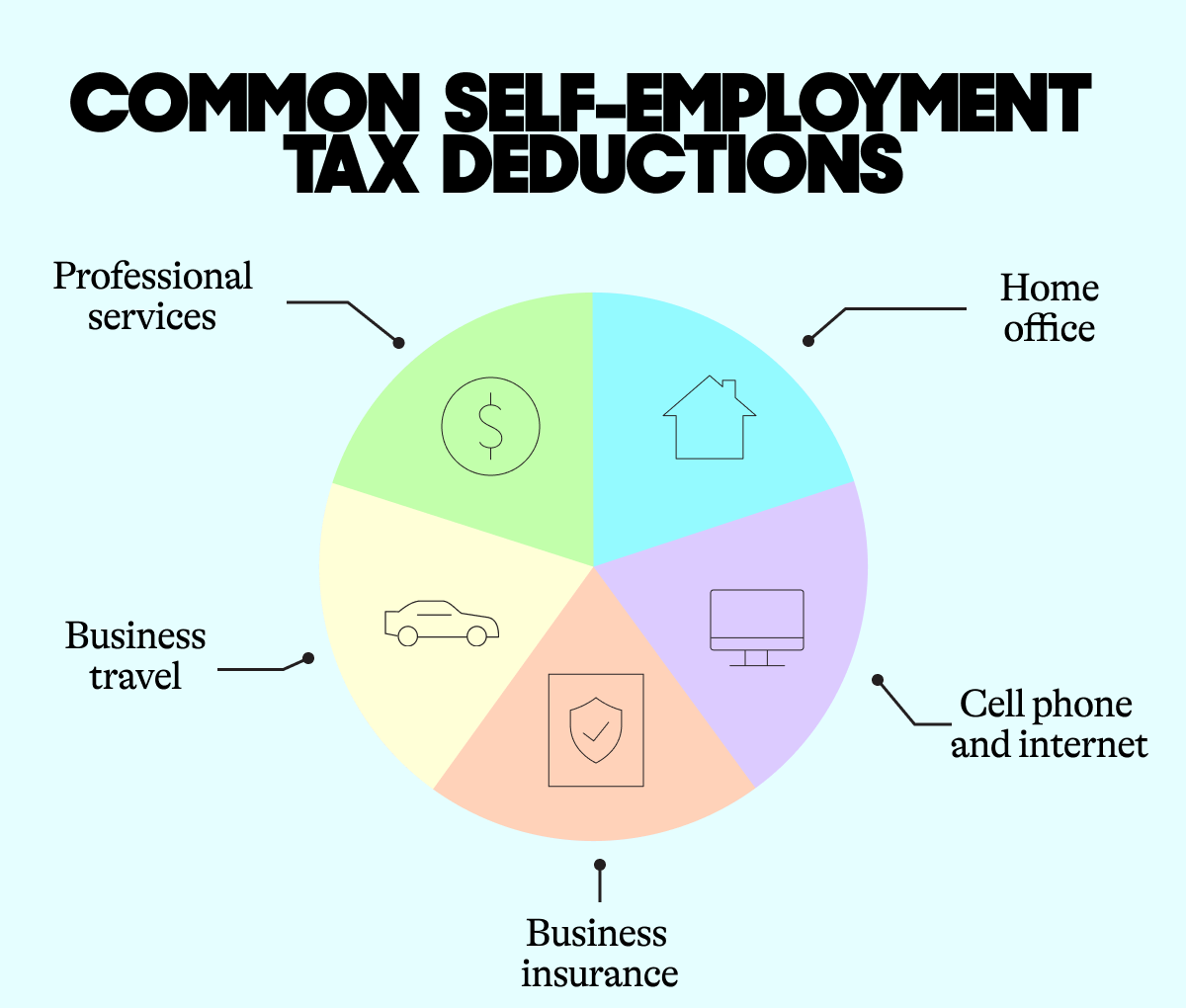

The Firm Accounting™️ on Instagram: Empower your self-employment

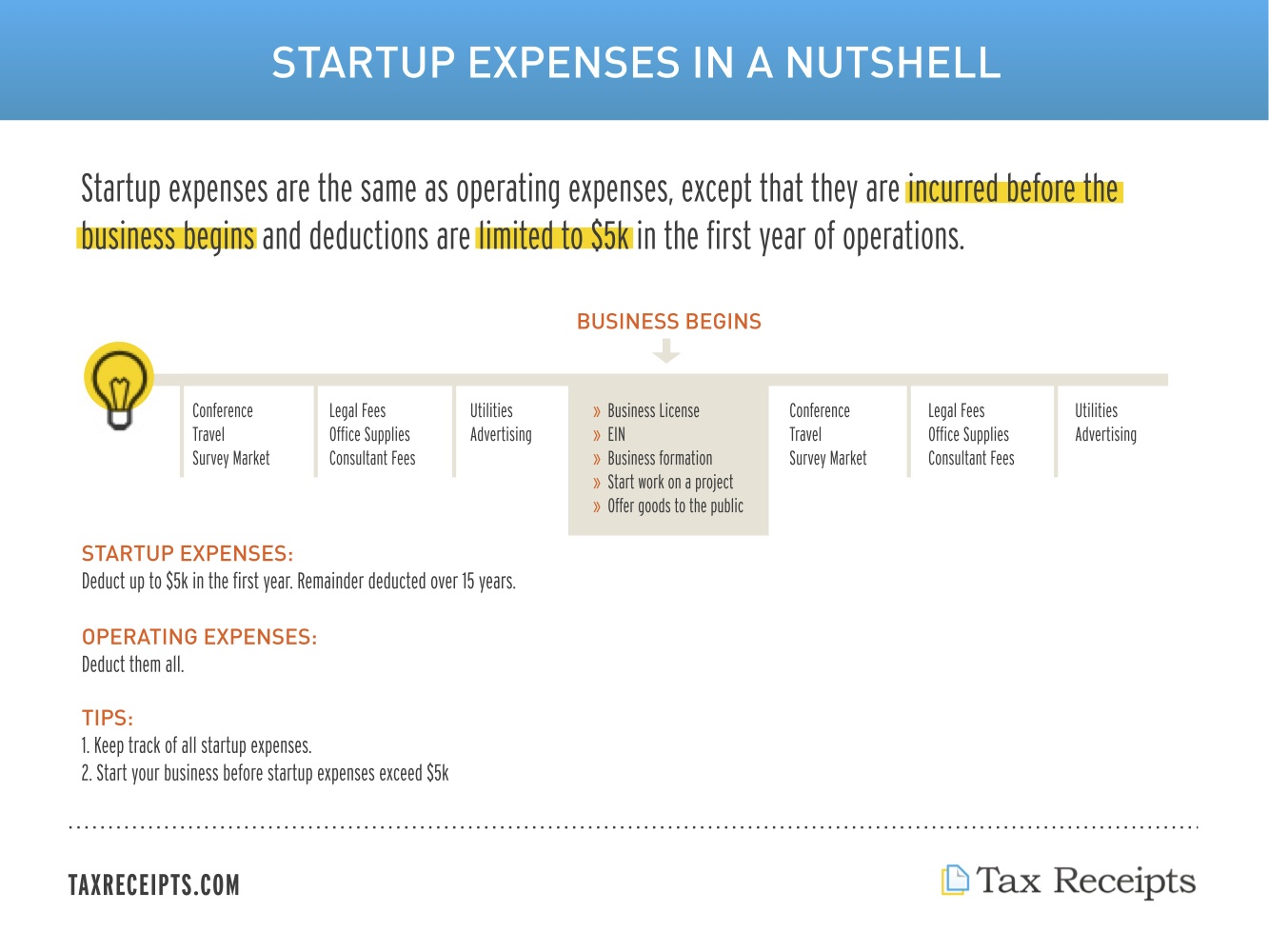

Small Business Expenses & Tax Deductions (2023)

:max_bytes(150000):strip_icc()/91627241-56a0a4645f9b58eba4b25f83.jpg)

What Business Advertising Expenses Are Deductible?

:max_bytes(150000):strip_icc()/TermDefinitions_Administrativeexpenses-edit-5881cd51f0f24307a2291566ce0efc1b.jpg)

What Are Administrative Expenses, and What Are Some Examples?

Office Supplies vs. Office Expense vs. Office Equipment

IRS Section 179 and Eligible Property: What to Know in 2022

:max_bytes(150000):strip_icc()/TaxPrepDeduction_GettyImages-638953230-24eb5a7f108f49adb6937a499c616127.jpg)

Business Expenses To Include in Budgeting and Taxes

The Definitive Guide to Common Business Deductions

:max_bytes(150000):strip_icc()/sgaExpenses-57d2c13f16bf417c805124f301e13ec4.jpg)

SG&A: Selling, General, and Administrative Expenses

Home office tax deduction for small businesses

IRS tax deductions for your online business expenses - Traverse

SG&A Expense Formula + Calculator

16 Amazing Tax Deductions for Independent Contractors In 2023

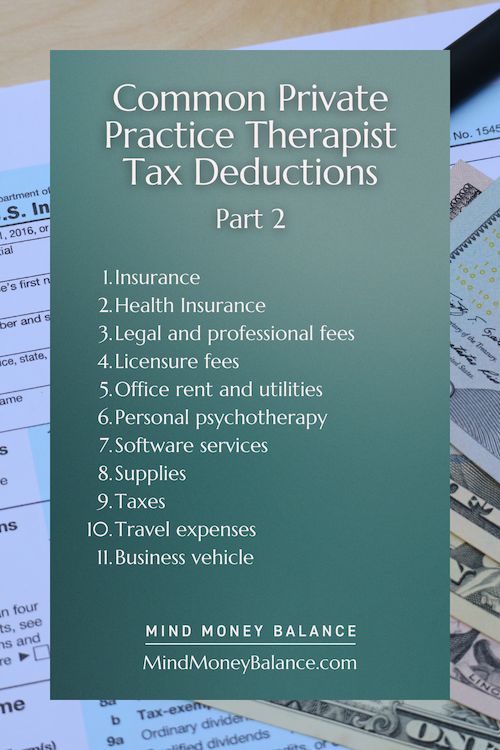

Tax Deductions for Therapists → 15 Write-Offs You Might Have Missed