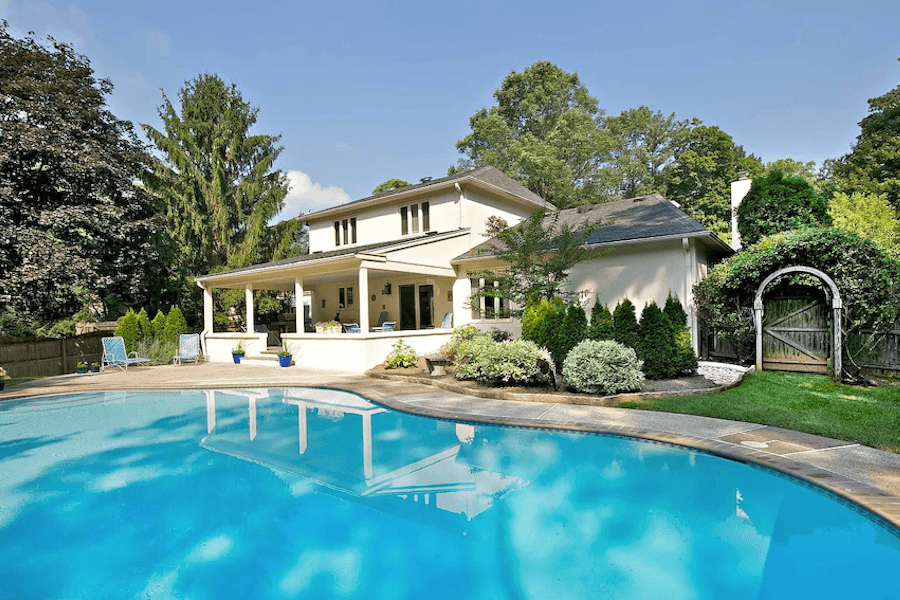

I Want to Write off Real Estate Losses: Is This Your Situation

Corrigan Krause is a team of dedicated, passionate, experienced professionals who provide comprehensive accounting, tax and consulting services and solutions to individuals and privately-held businesses to help you make informed financial decisions.

Proof of Loss: The Ultimate Guide – Brelly

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax: What It Is, How It Works, and Current Rates

real estate Archives - Corrigan Krause, Ohio CPA Firm

Tax Deductions Made Easy: The Rental Real Estate Loss Allowance Explained - FasterCapital

Real Estate Losses Against Ordinary Income - Passive Income MD

Reducing Tax Liability: The Rental Real Estate Loss Allowance Advantage - FasterCapital

:max_bytes(150000):strip_icc()/GettyImages-1286401212-4d2ec85e2b4944f8a9d1241a192c69e3.jpg)

What Is the Rental Real Estate Loss Allowance?

Capital Loss Tax Deductions for Real Estate - Shared Economy Tax

:max_bytes(150000):strip_icc()/tax-loss-carryforward.asp-Final-b28809370a574b75ab8b3f17621f3287.png)

Tax Loss Carryforward: How They Work, Types, and Examples