:max_bytes(150000):strip_icc()/portfolio-variance.asp-Final-a5efd061d3ff4a28a72b63b2b0ffc0f9.png)

Portfolio Variance: Definition, Formula, Calculation, and Example

Portfolio variance is the measurement of how the actual returns of a group of securities making up a portfolio fluctuate.

Portfolio Variance - Definition, Calculate, Formula

Portfolio Risk: Analytical Methods AnalystPrep - FRM Part 2 Study Notes

:max_bytes(150000):strip_icc()/GettyImages-11707409691-57a69e39b23448f8b091d8c355b9d0ad.jpg)

Post-Modern Portfolio Theory (PMPT): What it is, How it Works

Mean-Variance Portfolio Performance

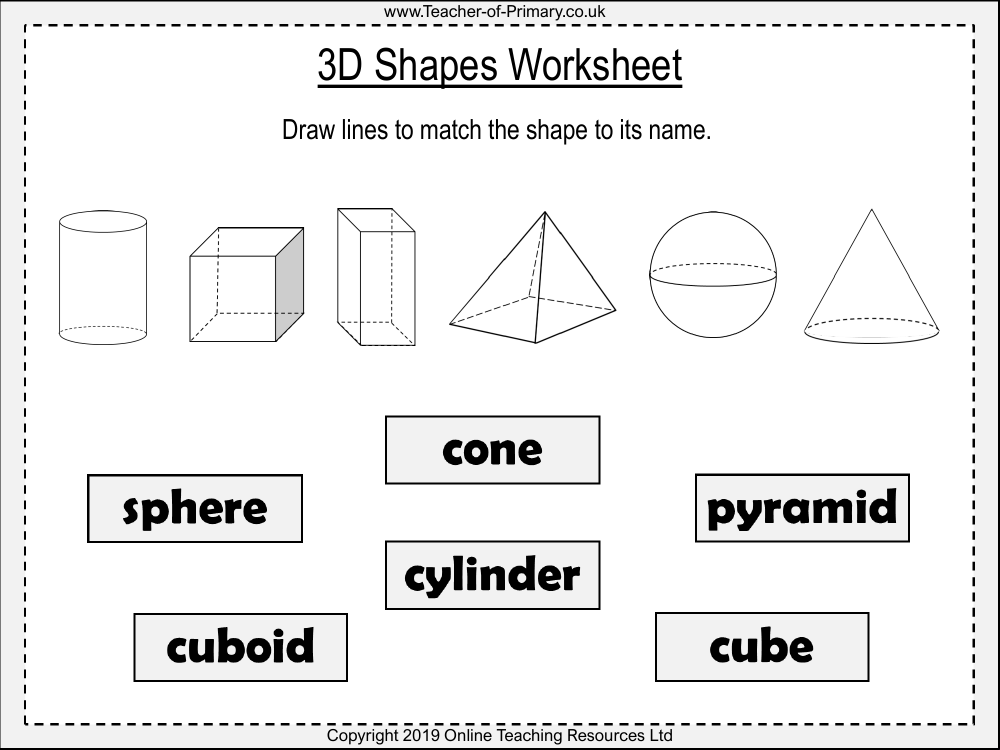

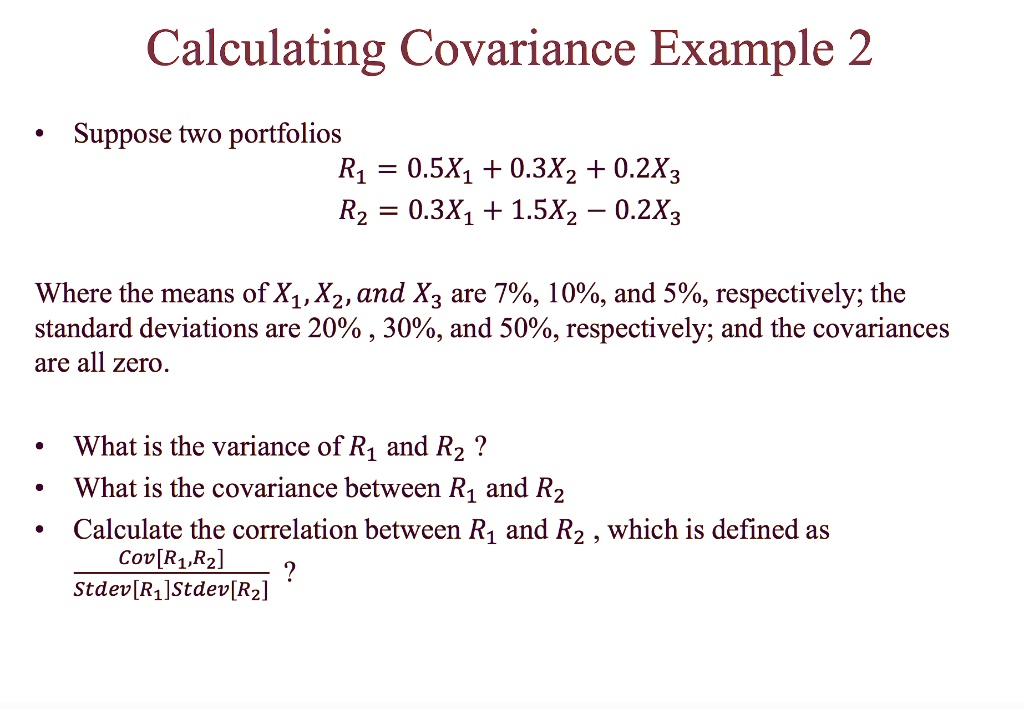

SOLVED: Calculating Covariance Example 2 Suppose two portfolios: R1 = 0.5X1 + 0.3Xz + 0.2X3 Rz = 0.3X1 + 1.5Xz + 0.2X3 Where the means of X1, Xz, and X3 are 7%

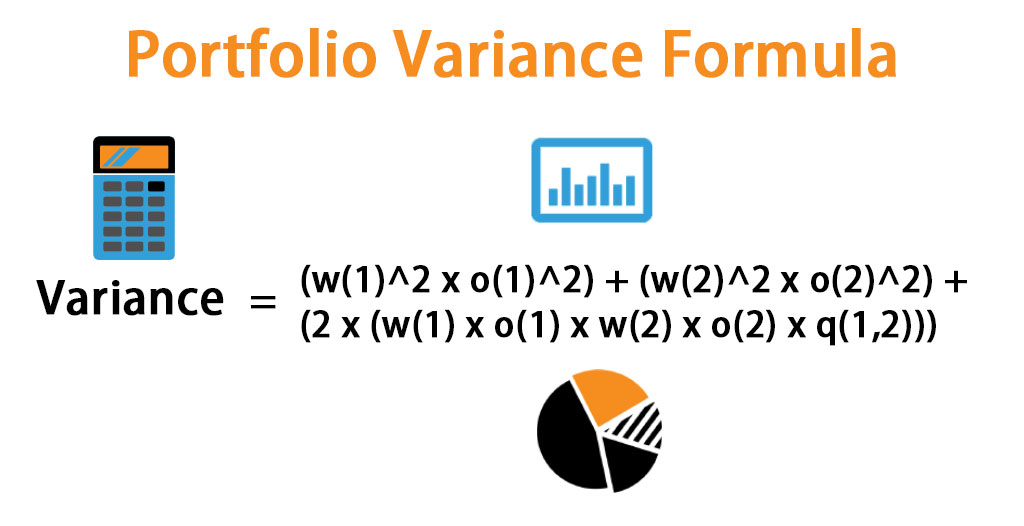

Portfolio Variance Formula How to Calculate Portfolio Variance?

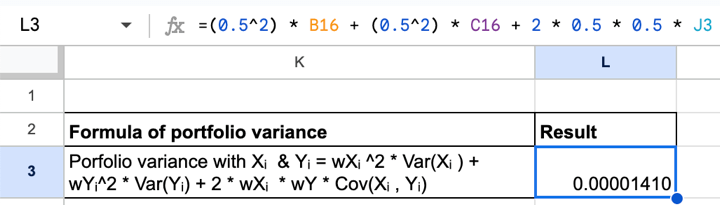

Covariance Matrix and Portfolio Variance: Calculation and Analysis

What is Minimum Variance Portfolio? - Definition, Meaning

:max_bytes(150000):strip_icc()/Value_At_Risk-41be4adde1ef4915a1ca7f85407d77c6.jpg)

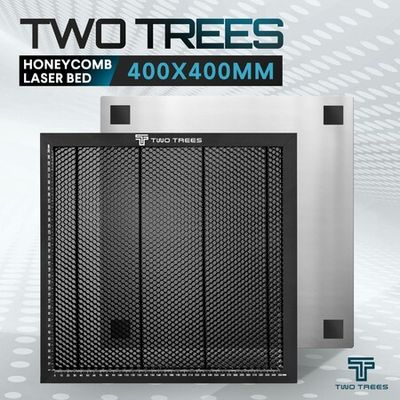

What Is the Parametric Method in Value at Risk (VaR)?

FIN330 - Notes - Capital Structure Theory Trade Off Theory ○ Debt level are chosen to balance - Studocu

Portfolio Return and Variance, Covariance and Correlation - PrepNuggets

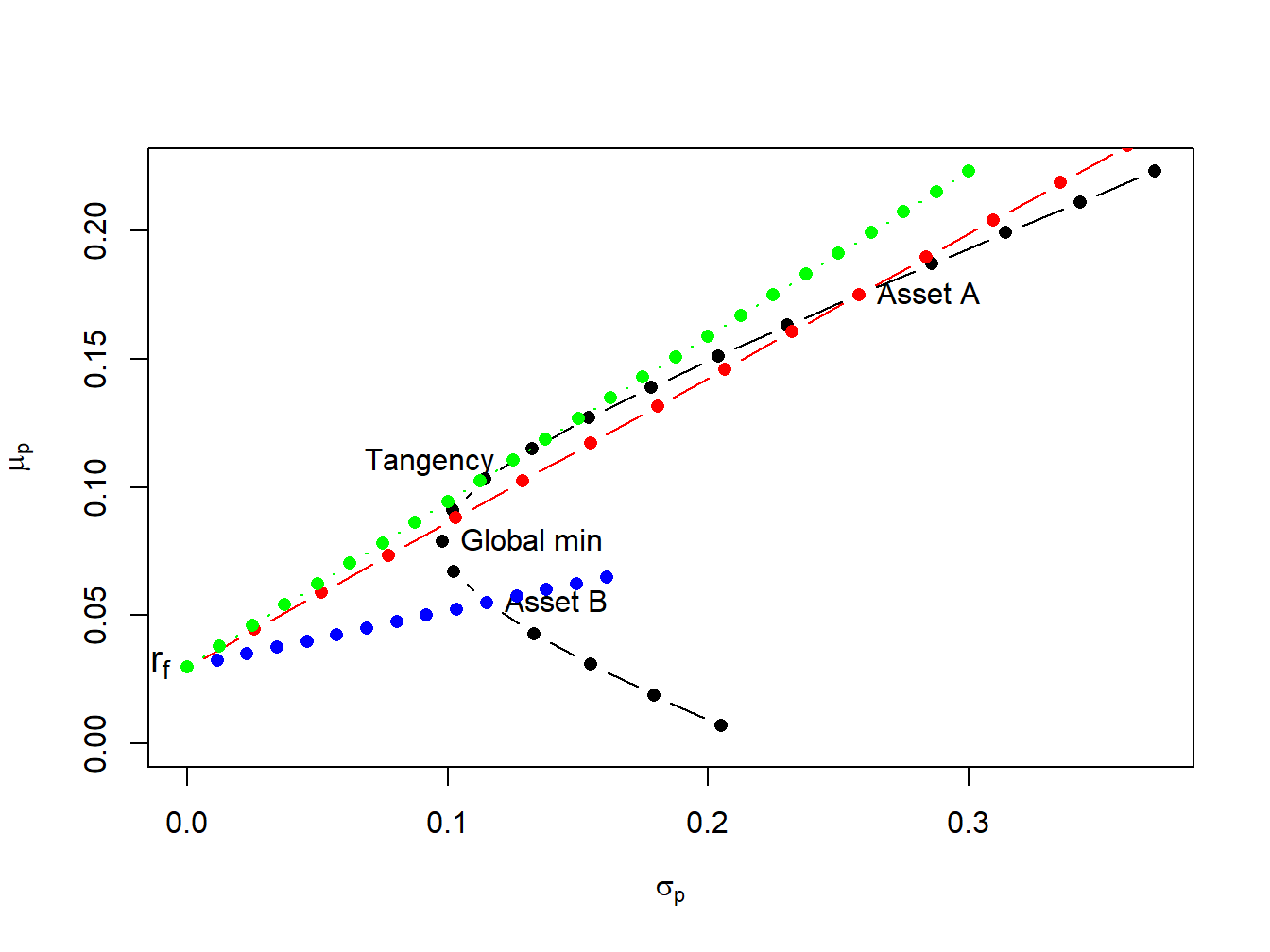

11.5 Efficient portfolios with two risky assets and a risk-free asset Introduction to Computational Finance and Financial Econometrics with R

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)

Modern Portfolio Theory: What MPT Is and How Investors Use It

:max_bytes(150000):strip_icc()/Variance-TAERM-ADD-Source-464952914f77460a8139dbf20e14f0c0.jpg)

What Is Variance in Statistics? Definition, Formula, and Example

How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent