Daycare Tax Deductions: Save Big with IRS-Approved Benefits

4.8

(558)

Write Review

More

$ 25.50

In stock

Description

Discover essential daycare tax deductions for your daycare business, from travel expenses to childcare supplies. Get IRS-approved tips to maximize savings.

HSA-Eligible Expenses in 2022 and 2023 that Qualify for Reimbursement

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly Payments - NCBlpc

Adopting a child: Tax planning considerations - Journal of Accountancy

You Could Save Thousands of Dollars This 2023 Tax Season - National Women's Law Center

16 ways business owners can save on taxes - Clover Blog

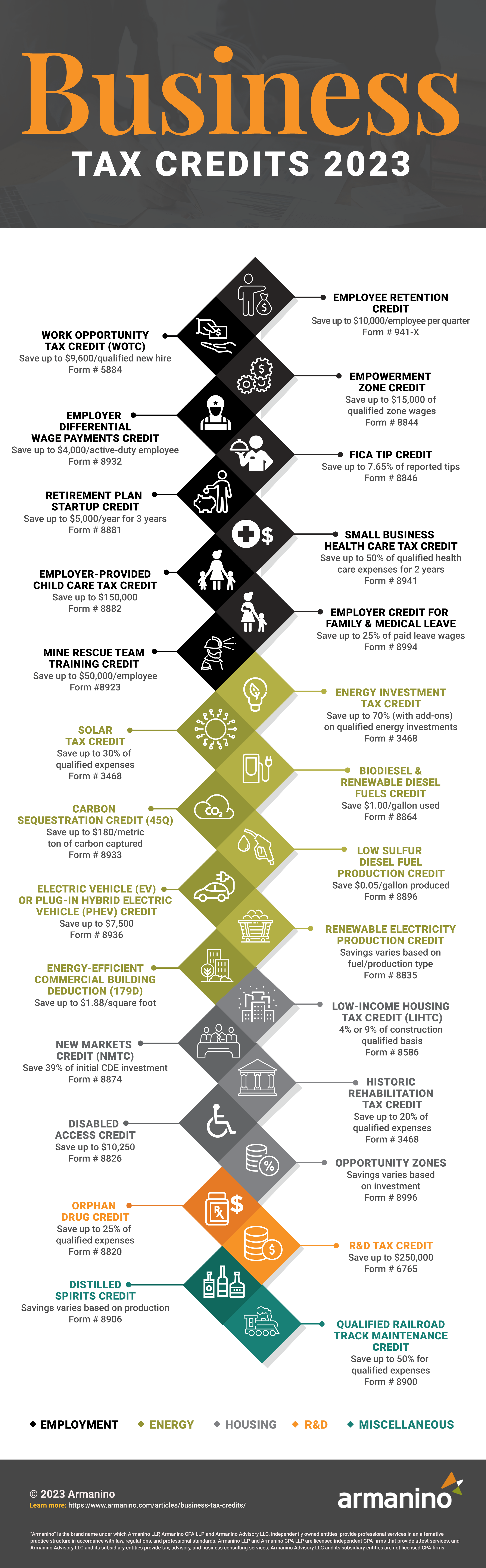

Business Tax Credits 2023

The Ins and Outs of the Child and Dependent Care Credit - TurboTax Tax Tips & Videos

10 Crazy Sounding Tax Deductions IRS Says Are Legit

Child Care Tax Receipt and Statements Guide & Templates

Related products

You may also like