Can You Donate Art and Collectibles to a Private Foundation? Understanding the Tax Implications

Our mission is to amplify the positive impact of private foundations and philanthropic families by providing specialized tax and accounting services that fit their unique needs.

Inflation's impact on giving, and how to insulate your clients – Ren

Private Foundations and Expenditure Responsibility: A

Art donations: A guide for collectors

Private Foundations and Expenditure Responsibility: A

Private Foundations and Municipal Bonds: An Imperfect Fit

Donating Passion Assets (Tangible Personal Property Donations)

What You Need to Know About Tax Deductions for Donating Art

Private Foundations: Unleashing the Potential of Program-Related

Collectibles and IRS Pub 544: Tax Rules for Art and More - FasterCapital

An art collection is a special asset to account for in an estate plan - Miller Kaplan

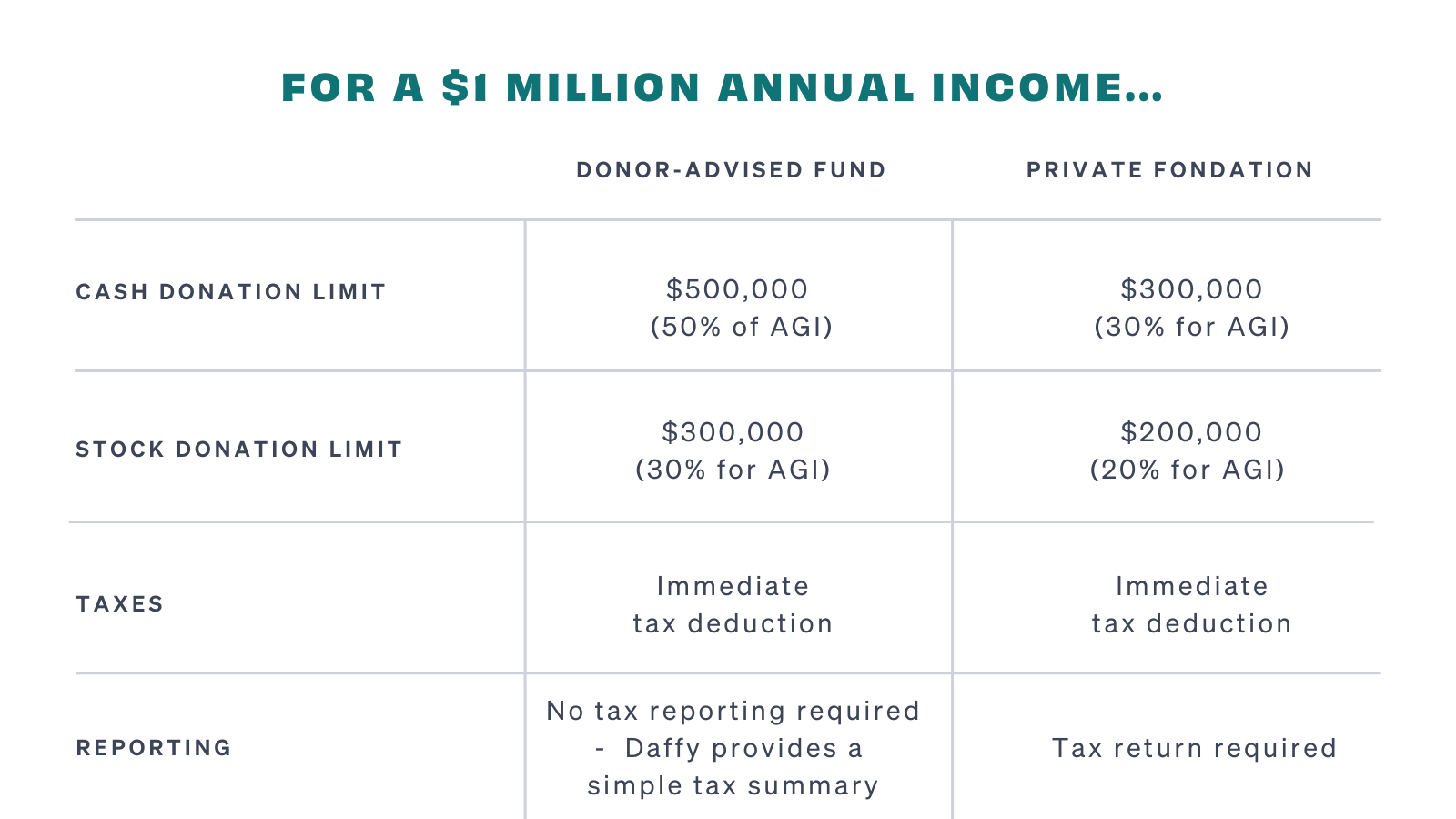

Donor-Advised Funds vs. Private Foundations: What's Best

Balancing Act: Weighing the Pros and Cons of D&O Insurance for

Supporting Charity with Works of Art

5 Reasons Collectors Should Hire an Art Law Attorney